The SPAC market has cooled off recently amid fears of frothy valuations and last month the SEC suggested warrants issued by SPACs should be accounted for as liabilities instead of equity instruments. The valuation is down from the more than $2 billion that sources told Reuters in March Wejo had hoped to achieve.

SPACs are shell companies that raise funds to acquire a private company with the purpose of taking it public, allowing such targets to sidestep a traditional initial public offering (IPO) to enter public markets. Reuters had previously said Wejo and Virtuoso were in talks. The new company will trade under the symbol "WEJO" but the stock exchange has not been determined. The merger with Virtuoso is expected to close in the second half of the year, the companies said. "All this opportunity to monetize it, it's almost limitless." "The future is data and this is a company that's sitting there right in the middle of this incredible wave of data that's coming," Virtuoso CEO Jeffrey Warshaw said in an interview.

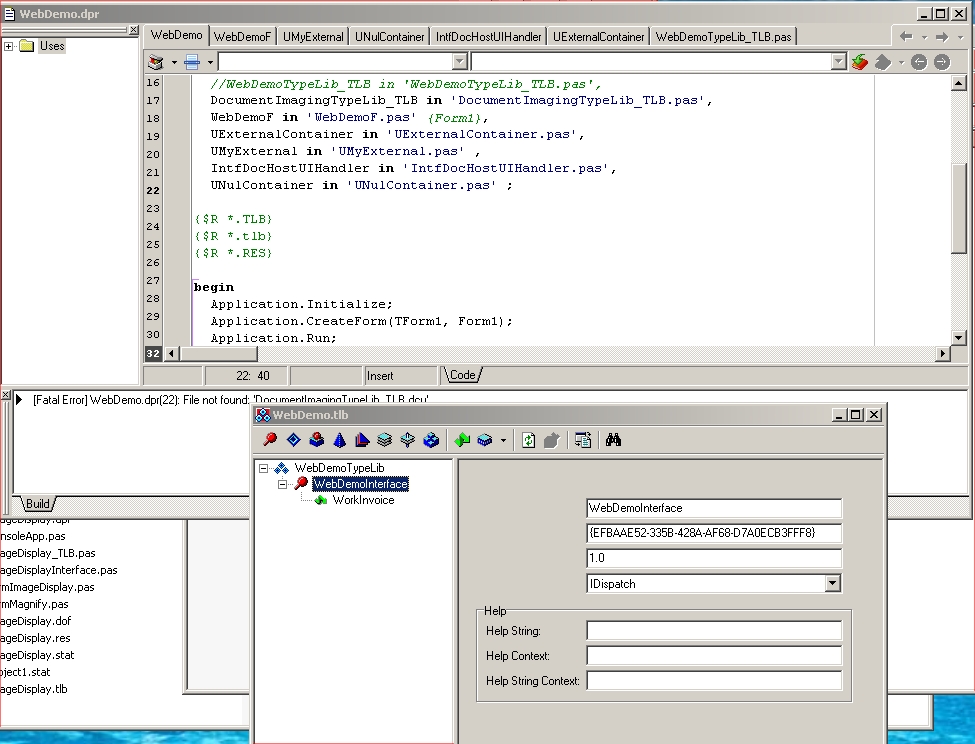

Autodata file not found pro#

The $800 million enterprise value for Wejo implies an estimated $1.1 billion pro forma equity value. The sizes of their investments or stakes were not disclosed. automaker GM, which previously invested in Wejo, as well as data management company Palantir Technologies Inc (PLTR.N), which billionaire Peter Thiel co-founded, Wejo and Virtuoso said. An additional $25 million could be raised within the next month as talks continue with other potential investors, he said. Wejo Chief Executive and founder Richard Barlow said institutional investors make up most of the PIPE, but declined to identify the firms involved. That includes $230 million from Special-Purpose Acquisition Company (SPAC) Virtuoso and another $100 million referred to as Private Investment in Public Equity (PIPE). The deal will raise $330 million in proceeds for Wejo, the companies said.

DETROIT, May 28 (Reuters) - Auto data startup Wejo, backed by General Motors Co (GM.N),will go public through a reverse merger with blank-check company Virtuoso Acquisition Corp (VOSO.O) in a deal that values the British company at $800 million including debt, the companies said on Friday.

0 kommentar(er)

0 kommentar(er)